Account Options

Pennsylvania Uniform Transfers to Minors Act (PUTMA)

PUTMA accounts consist of funds that are irrevocably gifted to the minor beneficiary and managed by a single custodian, such as a parent, grandparent, or other interested person. Open to minors under the age of 21 who are eligible for membership.

Account Features:

$5.00 minimum deposit and balance

Automatic enrollment in the Level Up Youth Program

Dividends earned on PUTMA accounts are considered income to the minor for income tax purposes

The minor's Social Security number is provided to the Internal Revenue Service (IRS). It's recommended that the Custodian seeks tax advice from the IRS before opening this account

The Custodian can name a successor custodian at any time

Only the Custodian is authorized to conduct transactions on the account and is responsible for transferring funds to the beneficiary upon reaching age 21

Savings

At age 12, a youth can open their own regular share account¹. An adult is not required unless a Visa® Debit Card is desired. With a joint owner at least 18 years of age, both the youth and joint owner may be issued a debit card in their own names. The adult joint owner will not be automatically removed from the account when the child turns 18 but may choose to remove themself at that time.

Account Features:

$5.00 minimum deposit and balance

Automatic enrollment in the Level Up Youth Program

Earn dividends

Access and manage funds through Online and Mobile Banking

Visa® Debit Card with joint owner at least 18 years of age

Checking

From the age of 14, a teenager may open a share draft (checking) account jointly with a qualified² adult aged 18 or older, in addition to maintaining a regular share account. The adult joint owner will not be automatically removed from the account when the child turns 18 but may choose to remove themself at that time.

Account Features:

No minimum balance

Earn dividends

First order of checks free (Basic Style)

Access and manage funds through Online and Mobile Banking

Visa® Debit Card with joint owner at least 18 years of age

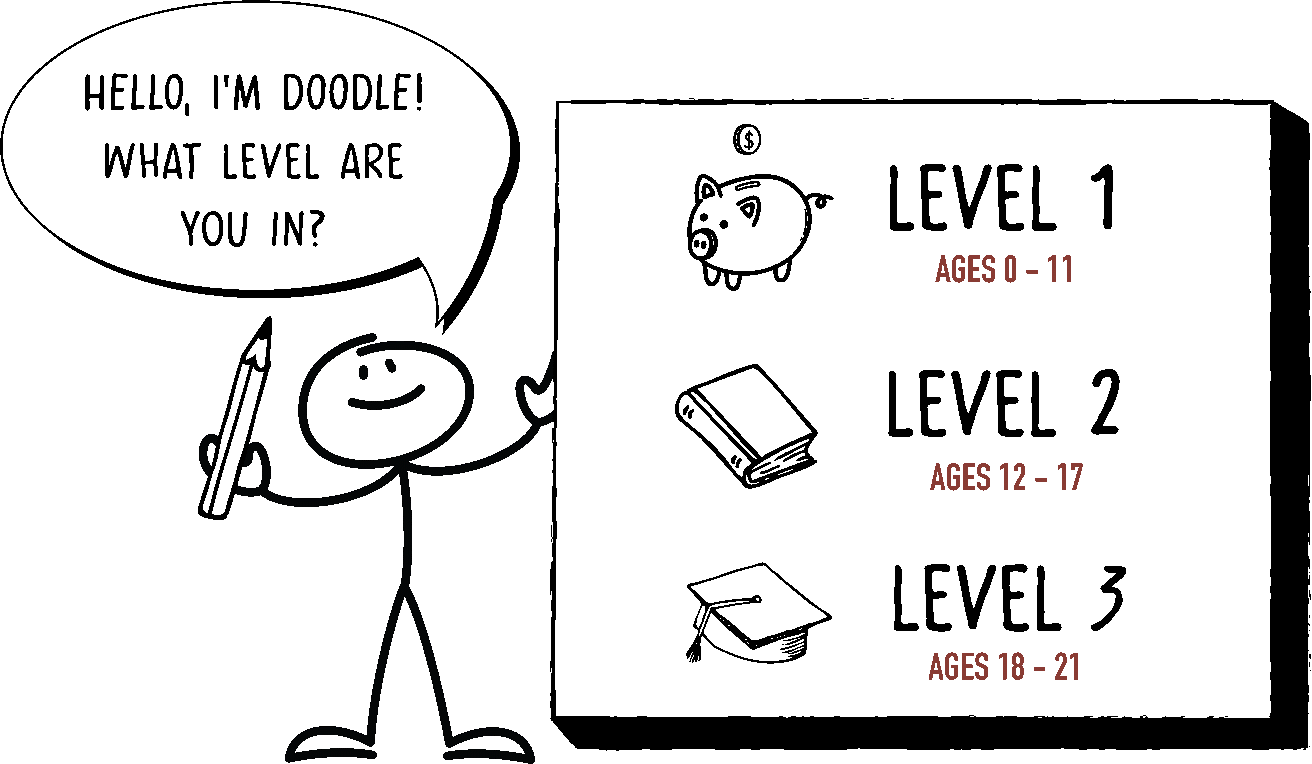

Level Up Youth Program

We're committed to delivering an interactive and enjoyable learning experience that equips our youngest members with essential money management skills for today, tomorrow, and in the future.

From mastering saving and budgeting basics to navigating complex financial decisions like car purchases or managing student loans and credit cards, we've got it covered. Through a blend of games, activities, events, incentives, and educational resources, we've made learning about finances both fun and engaging. Join us on this exciting journey of financial empowerment!

Program BENEFITS

Save & Invest

(0-11)

Helps children learn how to start saving their money and investing in their futures at an early age.

Free Gift³ upon opening a regular share (savings)

Savings Tracker to record transactions

Earn Level Up Bucks for toys - One Level Up Buck for every $10 deposited with a daily limit of 10, in-person only

Practical Money Skills - Fun games introducing money concepts

Learn Good Habits

(12-17)

Encourages teens to learn good habits when managing their money to prepare them for the future.

Free Gift³ upon opening a regular share (savings) or when you level up

Practical Money Skills - Comics and games designed to instill good habits

Zogo Financial Literacy App⁴ – Learn, play, and earn points for gift cards

Financial Independence

(18-21)

Inspires young adults to become financially independent and achieve their goals.

Free Gift³ upon opening a regular share (savings) or when you level up

Loan Discount Coupon upon opening a regular share (savings) or when you Level Up

Practical Money Skills – Financial tools and resources

Zogo Financial Literacy App⁴ – Learn, play, and earn points for gift cards

-

¹The minor’s social security number and two forms of identification must be provided to open a youth account.

²Review of account history required and not all applicants will qualify.

³Must visit an LVECU location to receive gift.

⁴Zogo Financial Literacy App intended for ages 13 and up.